Longevity Risk: The Risk You’re Going to Go Broke Before you Die.

This past weekend I read an interesting statistic during my ritual of reading Barrons.

According to the World Health Organization, 50% of babies born in 2017 will live to be 104 years old.

I was floored. My daughter was born in 2014 and I’m sure the predictions for her are similar.

I’m expected to live until I’m 80 – the life expectancy of a 50-54 year old. Since my daughter is only 5 years old at the moment – if she does live to be 104 and I end up passing on as predicted when I turn 80, it means I would only have been around for 1/3rd of her life. So while some folks are already saying they don’t want to live TOO long, I’m one of those people that wants to live as long as I can. In fact, I promised my daughter I’d TRY to live to be 100. Notice I said ‘Try’ – as we all know, nothing is certain.

But what if I do live to be 100 years old? Will I have enough saved up to pay my expenses until then? What if I become ill and my health care costs skyrocket? The older we get, the higher these costs will be. These are questions we should all be asking ourselves unless of course, you already have enough money saved up that based on your current and expected expenses, will not deplete your retirement account. If that’s you, you’re in the minority. The rest of us have some planning to do and it needs to start sooner rather than later.

Longevity Risk

According to Investopedia,

Longevity risk refers to the chance that life expectancies and actual survival rates exceed expectations or pricing assumptions, resulting in greater-than-anticipated cash flow needs on the part of insurance companies or pension funds – or our personal retirement accounts.

When you combine increasing life expectancies with the fact that 25% of American workers have no retirement savings, only 32% of American households have IRAs, only 16% of Americans age 50+ make ‘catch-up’ contributions, and only 14% of American households have $250K or more in retirement savings – you have a recipe for disaster.

Longevity risk is the risk that most investors put off until later. It’s last on the list of risk management priorities because we tend to focus on the here and now (and rightfully so) without giving much consideration to our future.

Other Risks that Investors Prioritize

In our day to day lives, we worry more about the risk of getting hit by a car, or losing our jobs, or making sure our children are safe. As it relates to investments, the biggest risk we worry about is the risk of loss. If you invest in a friend or relative’s business and it goes under, there’s a good chance your money is gone.

A close second is volatility risk – which is more relevant to investable securities and the ups and downs of the markets that affect the prices of these securities. If you’re well diversified, the risk of material loss is minimal, but you might still experience high levels of volatility that make you feel queasy.

These are more tangible risks we can mitigate now by making prudent decisions with our investments. But longevity risk – that one doesn’t get addressed oftentimes until it’s too late.

One of the Drawbacks of Simulations

Many advisors will create a financial plan for you with inputs that consider your current retirement balances, an amount you will continue to contribute annually, an average annual return, and a specific withdrawal strategy that maximizes either the amount you can rely on to pay your expenses or the length of time you could take those withdrawals.

The problem with simulations is that they don’t account for the non-linearity that is introduced once you start taking money out of your retirement account. I won’t bore you with statistical jargon but consider this, if you start with $100K, if your portfolio has a return of 2% per year, you will have $164K after 25 years. If your portfolio has a return of 4% per year, you will have $271K after 25 years. The difference between $271K and $164K is 64%. If your returns are 6% per year, your portfolio will be valued at $446K – 64% higher than $271K. So, for every 2% increase in returns, your portfolio will be 64% higher. That is a linear relationship that doesn’t change.

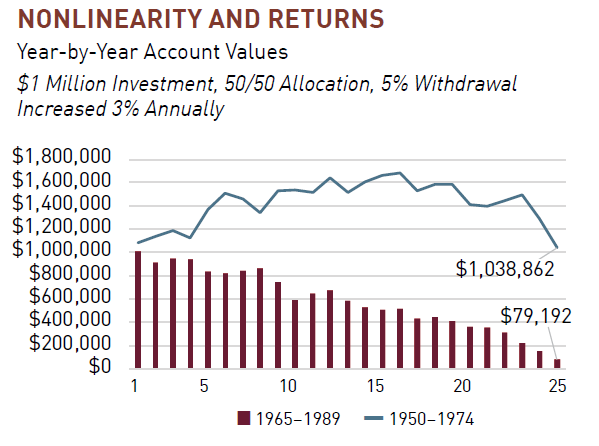

However, add in withdrawals and that relationship breaks down and could wreak havoc on any well thought out plan. The chart below shows two different 25-year periods. The starting point is the same, the allocation is the same, and the withdrawal rate and rate of increase is the same. In one example, you are left with just $79K after 25 years. In the other example, you end up with a balance of slightly over $1M. What was the reason for this difference? Pure luck and the sequence of returns when considering withdrawals.

Source: Investments and Wealth Institute

Here is another example:

Assume you start with $1M. If you’re down 10% and you also withdraw $50K (5%), your $1M is now only $850K. If you still need $50K annually, you now have to withdraw 5.9% of your portfolio. ($50K/$850K) and to get back to $1M, your portfolio has to have a return of 25% in the following year!! To do that, you need to be positioned aggressively – not a prudent strategy in your later years when you should be more conservative. The point is, what seemed like enough money to withdraw $50K annually for a considerable period of time – with one or two subpar years, your portfolio can go into a downward spiral – and you will run out of money before you expected.

Preparing for Longevity Risk

The most important step to take to deal with longevity risk later is to start planning for it now. You might need to save more aggressively, invest more aggressively, or think outside the box with an eye towards the future – like working for an employer offering a pension plan – although there aren’t many of those left. If you don’t have a plan set up then you’re taking on yet another risk – most women would call it ‘don’t ask for directionitis’, referring to the tendency for men not to ask for directions when we’re lost. A financial plan is your GPS for retirement. With something of such magnitude as your retirement, why wouldn’t you use it?

Assuming you plow through anyway or even create a financial plan – sometimes plans need to be adjusted – or sometimes they just don’t work out. That highway construction in the middle of the night could throw your ‘fastest’ route into one of the most scenic, yet time-consuming drives and turn a two-hour quick road trip into a 5 hour nightmare.

Regardless, there are things you can do later to mitigate longevity risk but you have to be flexible.

- Wait another year, or two, to take withdrawals. If you planned on retiring at 67, waiting until you’re 69 can make a huge difference.

- Be flexible about adjusting your lifestyle and income needs. Instead of taking two European vacations a year, perhaps you take one per year when the markets are down. That leaves more money in your retirement account for a subsequent recovery.

- Choose the most advantageous Social Security strategy. Taking it too early might result in a payout that is too low, and waiting too long to take it may result in you having to take more money out of your retirement account to fill the income gap in the meantime. There is an optimal strategy for you.

- Build some guaranteed income into your portfolio strategy. You’ve probably been offered an annuity by an insurance salesman at some point in your life. I abhor the way some of these products are sold to individuals who they aren’t a good option for. But they do have a place in some portfolios if properly positioned and in the right amount, with the terms and options that fit your specific needs. If you go this route, make sure the advisor you speak with is a fiduciary and is looking out for your best interests.

Conclusion

Longevity risk is real and might be one of the most ignored risks we evaluate as investors. With life expectancies increasing and costs of living rising as well, it is in your best interest to reevaluate your savings and investment options to determine if you’re exposed to any risks – even if they are risks that arise from doing nothing. In this case, doing nothing dramatically increases longevity risk. Make sure you do something to mitigate this risk in your future.