Don’t Outlive Your Money, Create a Financial Plan and Invest for Both Income and Growth

One of the biggest concerns you might face as you approach retirement is whether there is enough money in your account to last for the rest of your life. You might have a general idea of how much you will have in your portfolio by the time you retire and use life expectancy tables to determine how long that might be, but as far as the latter, no one really knows when our number will be called.

The general rule of thumb for withdrawing from your portfolio in retirement is 4%. I won’t argue if you suggest it should be higher or lower because it really depends on your unique circumstances. You might need a 4% withdrawal rate to pay for your monthly expenses while one neighbor might only need 3% and the other neighbor needs 5%.

The reason why 4% is a good benchmark, in my opinion, is because if you retire at 65 and the portfolio sits in cash without generating any returns at all, it would still take 25 years for the balance to reach zero – and you would be turning 90 – a possible but not likely life expectancy for most.

Many income investors naturally come to the conclusion that if they invest in a portfolio that pays a dividend yield of around 4%, that would be enough to retire comfortably. But without any growth in either the underlying stock price and/or the dividend paid, the amount of returns generated solely from dividends won’t be enough to cover the rising costs of inflation in retirement.

Without growth, you will be forced to keep looking for stocks that pay ever higher dividend yields and eventually you will start investing in stocks whose risks are not consistent with the conservative strategy you need in retirement.

What I want to show in this article is how long your portfolio will last given a certain level of distributions combined with a range of possible return outcomes and how inflation impacts the rate of depletion of your portfolio.

Since everyone’s tax situation is different, I will assume that the withdrawal amount considers tax liabilities so that whatever is left after paying Uncle Sam is the amount needed to cover ongoing expenses.

In other words, if you need a 4% distribution to cover expenses and your effective tax rate is 25%, then your withdrawal rate will be 5%.

The Good News

The good news is that if you only need to withdraw the 4% benchmark, your required return is quite reasonable and achievable. If you withdraw 4% of your investment portfolio and the portfolio returns 4% annualized, barring a very unfavorable sequence of returns, your portfolio will likely not be depleted in your lifetime, and you can leave it to your children or donate it to your favorite charity. 4% is not a terribly high target return and very achievable using conservative strategies that will minimize volatility and capital losses.

However, If your returns fall below the withdrawal rate (whatever that withdrawal rate is) on an ongoing basis, then the portfolio will have a finite life and you will be left to figure out how long you have before you run out of money.

Returns versus Distributions and How it Affects Portfolio Balances

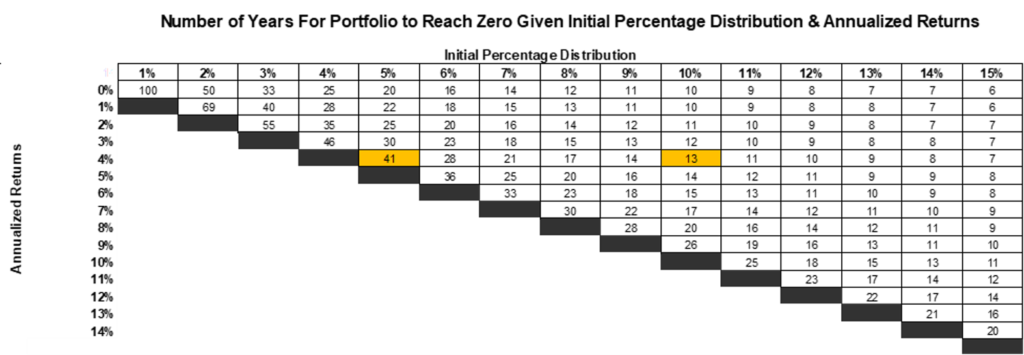

For example, at a 5% distribution and a 4% return, it would take 41 years for the portfolio balance to reach zero – see table below.

If that distribution rate increases to 10% however, the portfolio will be depleted in just 13 years. If you retire at 65 and your life expectancy is 80, the first scenario is fine, the second one is not.

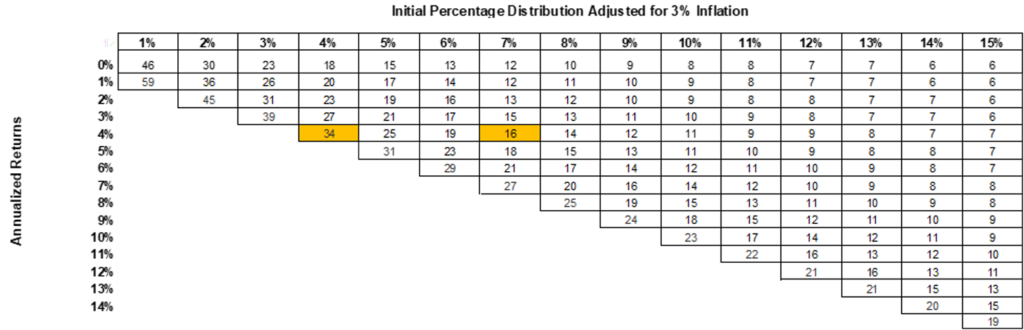

Unfortunately, when we first calculate the distribution amount needed from the retirement portfolio we oftentimes forget to adjust for inflation. We don’t have much inflation in the current environment but for modeling purposes, I built in a 3% inflation rate on the distribution amount needed, in order to compare how long the portfolio would last if distributions started at a specific percentage of the balance and increased 3% annually to account for inflation.

At a 4% initial distribution and a 4% annualized return, with no inflation, the portfolio balance could last forever – but with inflation that is no longer the case. Adjusting for inflation, with income needs driving higher distribution requirements every year, a portfolio generating a return of just 4% will end up depleted in 34 years. That is still quite a long time, but now you must plan for the possibility of running out of money.

It’s much worse if the distribution rate starts at 7% of the balance and is adjusted for inflation – at a 4% return – the portfolio balance reaches zero in just 16 years.

It’s important to also distinguish between total return versus the income generated from the portfolio from dividends or interest. When calculating return, I’m not using only income and dividends being generated – I’m assuming some capital gains as well. I really don’t care where the returns come from as long as the portfolio meets my return objectives. If part of the return is coming from income and another part is coming from capital gains, I can always sell some of my gains when the income isn’t enough. Again, so long as my total returns are adequate, I’m indifferent to how those returns are generated. This is yet another reason to look for dividend and growth instead of just high dividends.

Adding some numbers

Let’s assume you have $1,000,0000 and the amount you need to withdraw in your first year of retirement is around $50,000, which is enough to pay for any taxes owed and still leave you with the amount you need to cover your monthly expenses, which you also pay for using Social Security, a Pension from a previous employer, etc.

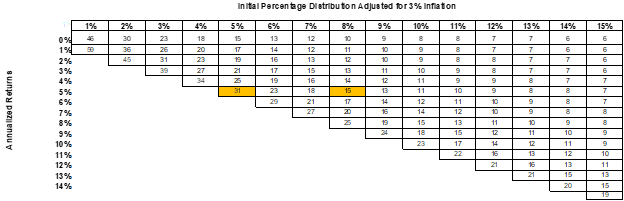

If you invest your portfolio to generate a total return of 5%, your portfolio should provide you with the needed amount of income, annually adjusted by 3% for inflation, for the next 31 years. See table below. If your initial balance on your portfolio is only $625,000 when you start withdrawing $50,000 per year, that’s an 8% initial distribution rate – that number drops by half – to just 15 years.

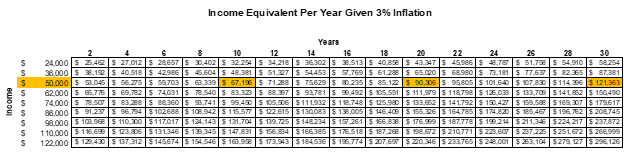

Just how much income are we talking about as the years go by? A $50,000 income requirement today is the equivalent of $67,000 in 10 years, $90,000 in 20 years, and $121,000 in 30 years. So if you start with a 5% dividend yielding portfolio today, it will need to yield 6.7% in 10 years, 9% in 20 years, and 12.1% in 30 years if your portfolio has not had adequate appreciation.

You may not have the same level of expenses, assuming you have less debt and are likely to have paid off your mortgage, but other expenses will continue to rise and I haven’t even factored in the costs of healthcare, which is likely to outpace the broad measure of inflation.

Planning Is Key

There is financial planning software that can be used to estimate your current net worth, portfolio returns, distributions, taxes, social security benefits, and a variety of other factors that together will be critical to whether your portfolio and the returns it generates will be enough for you to retire comfortably. I personally use Right Capital Financial Planning Software and offer it as a benefit to my Marketplace subscribers.

At a minimum, however, I suggest readers use the tables provided to get a guideline of where they stand, but delving into more details on specific planning techniques can help in a number of ways:

- Reduce the amount of income you need in retirement. This might include paying down debt or making sure some expenses are already paid or funded. Perhaps the use of an HSA account for future medical bills or using it to pay for long-term care insurance.

- Increase the amount of your portfolio balance at the time you retire by saving a bit more every year or investing with a goal to achieve higher returns – even if it means higher volatility. You might also adjust your expectations of your retirement date by a year or two so your portfolio balance can continue to grow before you start tapping it.

- Create additional income streams to supplement your income and depend less on the income from your portfolio. There are strategies on when it’s best to take Social Security, for example.

- Invest in such a way that either returns are higher and/or more predictable from year to year. This point is particularly important during times when the market is volatile and withdrawals are being made. A 5% withdrawal combined with a 10% decline in the portfolio in any given year means the total balance is now 15% less than it was when the year started. That level of decline would be hard to make up investing conservatively.

- You may even want to think about where you will live in retirement and look for places with a lower cost of living or no state income taxes.

The key is to start planning as early as possible so that when the day comes and you decide to call it quits, you have a good idea of how you are going to fund the rest of your life without having to worry about running out of money or having to adjust your retirement lifestyle due to unforeseen circumstances.

Comments are closed.