Weekly Wrap: Trade Deal Trumps Impeachment

- The House voted to impeach President Trump. The issue now moves to the Republican controlled Senate with little chance of a conviction

- A Phase 1 US-China trade deal gets done, which is welcome news to trade sensitive stocks.

- The Housing market continues to gain momentum – as expected – with homes sales getting traction and new building permits indicating prolonged strength.

- With markets hitting new highs, many traders are buying insurance against a strong pullback – particular around the time that the Democratic candidate may be chosen.

- High yield has outperformed but is now offering less upside for an elevated level of risk. However, opportunities still look attractive in emerging market equities and bonds.

Top Story

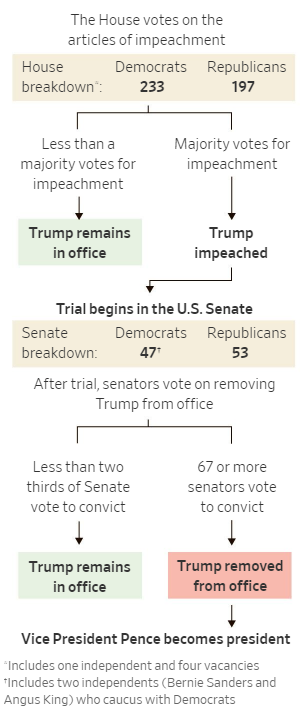

The house voted to impeach President Trump with the vote split among party lines. The two charges were abuse of power and obstruction of justice, and now the issue moves to the Senate, where a two-thirds vote will be required to convict Trump. With the Republicans having a majority in the Senate, a conviction would require a great number of Republicans to vote for impeachment – an unlikely scenario. At the end of all this the Democrats will have very little to show for their efforts and whether this entire ordeal negatively affects the Democratic party in the 2020 election remains to be seen.

Source: Wall Street Journal

The Economy

US China Trade Deal

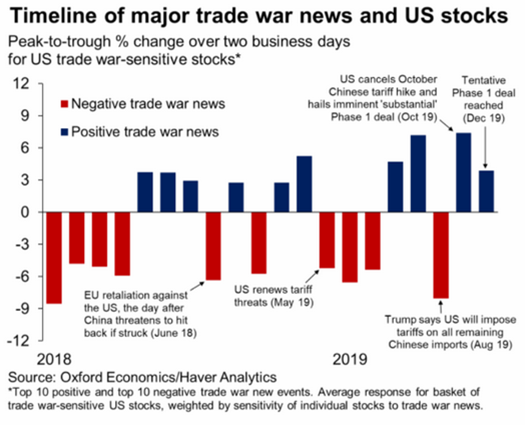

The US and China agreed to a Phase 1 deal on trade, which drove the markets higher, but not by much. It will be nice to get passed the highly volatile reactions that some stocks have had to news on the trade war. Stocks with a higher sensitivity to the trade war have had returns ranging from +6% to -9% over the two business days after major trade news was announced. If you were a savvy trader with a quick trigger finger, you might have been able to make some money on these movements but for the retail investor, the volatility is uncomfortable, to say the least.

Housing Market Going Strong – Maybe I Was Wrong

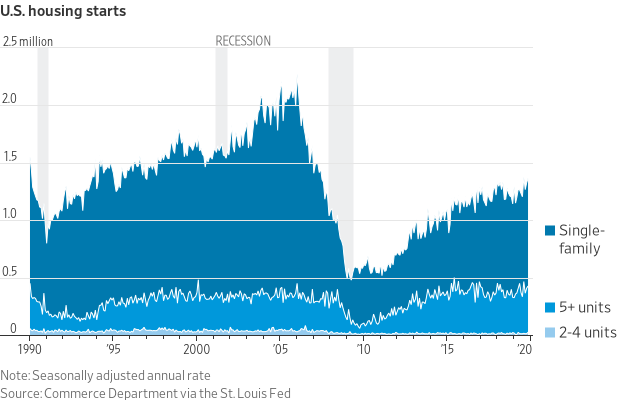

The 30-year mortgage rate remained steady at 3.73% this week, compared to 4.55% last year. I had mentioned that lower rates would likely lead to a boost in homebuying and that has been the case. One area that continues to indicate traction in the housing market is building permits. US permits to build multifamily buildings with more than 4 units increased to an annualized pace of 501,000 – the highest since July 2015.

Two major drivers for demand of apartments are young adults finally crawling out of their parent’s basements to create their own household as well as aging baby boomers downsizing from single family homes. With rates at historically low levels – again – home builders are also benefiting by allowing them to finance construction of these units at lower rates. The rise in building permits, being a leading indicator of construction, could indicate a boost to home building in Q4 and into 2020.

Already the construction of new homes has built up some momentum, and the November figure came in at an annual rate of 1.365 million – just below the 2019 peak in August and the highest since 2007.

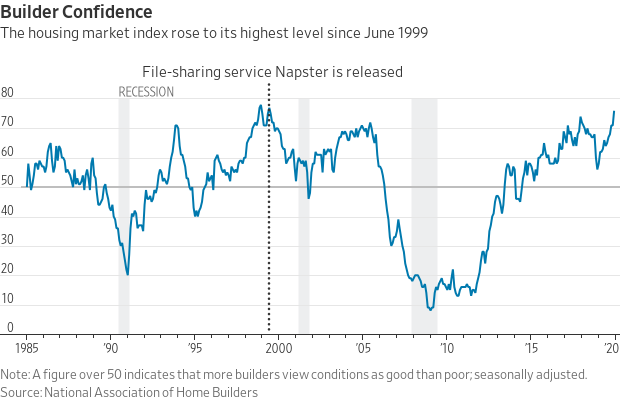

With builder confidence recovering throughout 2019 and now hitting the highest level since 2005, we could see housing drive further economic growth – something I figured would happen over the short-term but not sustainable. I might have been wrong on this one.

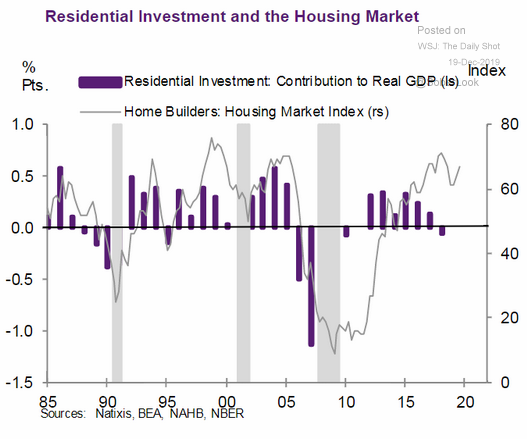

If the trend in the Home Builders Housing Market Index is any indication, we should see a dramatic increase in residential investment contribution to GDP in the coming year. Going back to 1985, when the Index has been this high, the average contribution of residential investment to GDP has been near 0.4%.

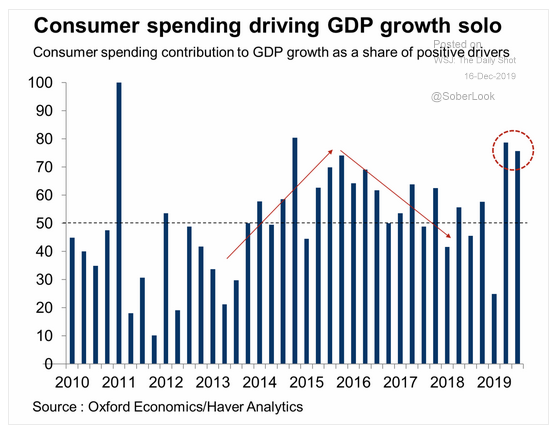

Consumer Spending Can’t Be the Lone GDP Driver

The US economy is driven primarily by consumption, with around 2/3rds of GDP being driven by consumer spending. However, when consumer spending becomes the only driver of economic growth, there is a heightened level of risk that if the economy doesn’t become more balanced, it could falter on a whim.

Market Recap

Markets Move Higher But Doubts Remain

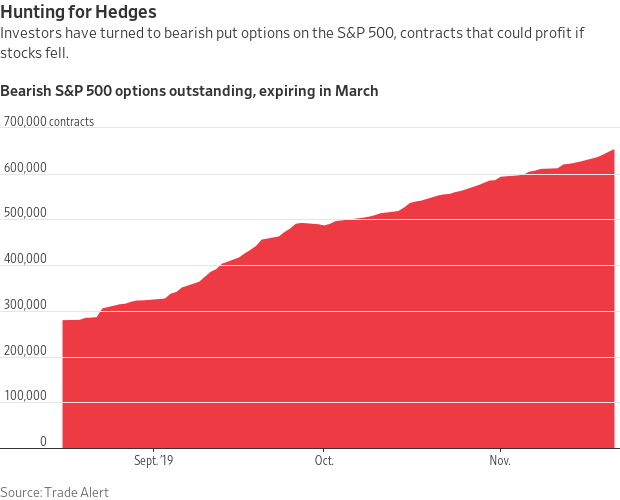

As the market (S&P 500) continues to hit new record highs, bulls continue to predict even higher returns, but some folks are starting to get a bit cautious, especially considering the Democratic candidate will likely be known by Q1 of 2020. The number of S&P put options outstanding that expire in March have increased from just under 300,000 contracts to around 650,000 contracts in just three months. It might also have to do with last year’s horrific market meltdown towards the end of the year, but the bottom line is that there is an increasing level of insurance being bought against a market decline.

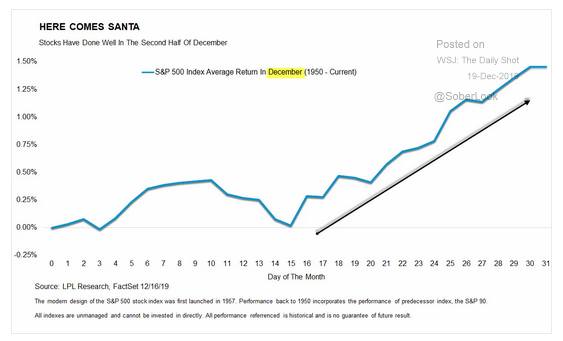

The good news is that the market usually performs well in the second half of December. On average, the returns on the S&P 500 are flat through the 15th and then gradually start climbing through the end of the year.

There is quite a bit going on in the last month of the year even if trading volumes might be lower. For example, there could be selling at the beginning of the month to take advantage of tax losses, while some of that cash might be put back to work towards the end of the month. There are strategies that call for buying some of the most beat up stocks towards the end of the year with the rationale being that these stocks will be sold off for tax loss harvesting but will be bought back after the 30 day wash rule. Smart traders might try to identify those stocks and get in early before investors start buying in again.

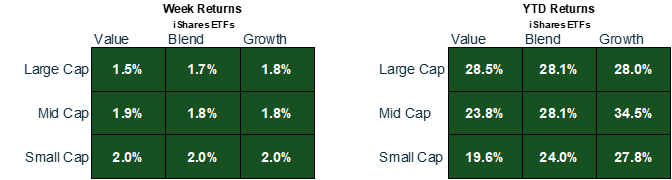

Personally, I like the risk/return profile of small and mid cap stocks – both of which have underperformed their larger cap counterparts in 2019. Cumulative flows into ETFs that invest in the smaller cap names have been increasing since Q3, which means it might not be such a well-kept secret.

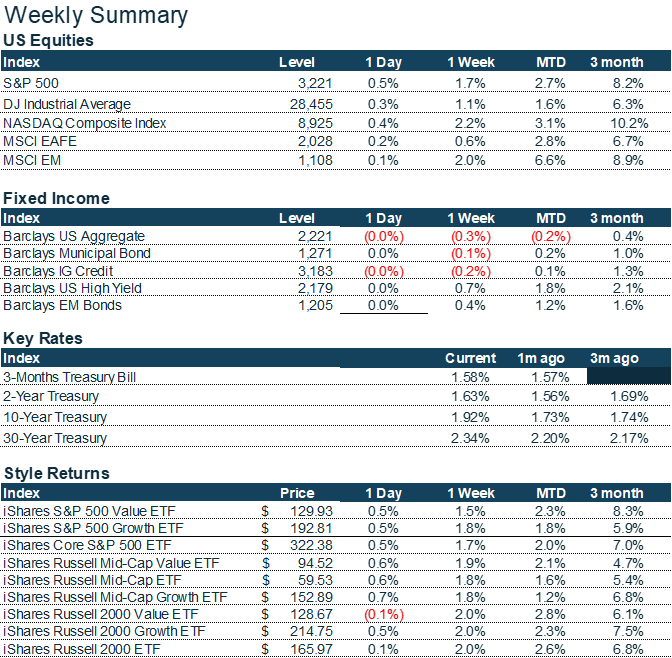

Markets continued their rise to new records as the phase 1 trade deal with China outweighed the impeachment vote that now moves to the Senate. Once again the NASDAQ led major indexes with a 2.2% increase followed by emerging markets at 2%. Both Chinese and South Korean markets were up more than 3% likely due to the easing of trade tensions and the agreed to deal.

Within the US, we also witnessed another strong week from small and mid-cap stocks, with small caps leading US equities with a return of 2% based on the iShares Russell 2000 ETF (IWM). YTD returns for small caps still trail mid caps and large caps, and especially when comparing Value strategies across the market spectrum. While small cap growth stocks have kept pace with large cap growth, small cap value has underperformed their larger peers by 9%.

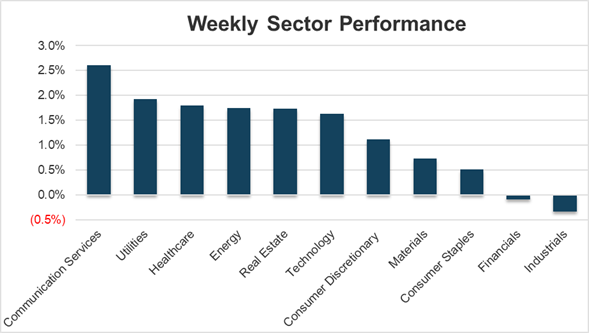

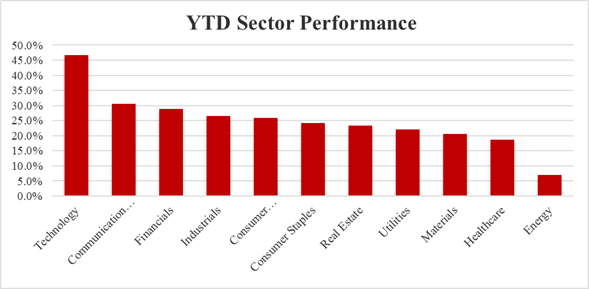

There was a shift back into defensive sectors with Utilities and Healthcare outperforming all but the Communication Services sector, which was up over 2.5% for the week. The sector was driven by a 6.3% return from Facebook (FB), which makes up almost 20% of the Communication Services Select Sector SPDR ETF (XLC) as well as Netflix’s (NFLX) 12.9% return – although NFLX’s weighting is just 4.8%.

Turning now to fixed income, not surprisingly, traditional fixed income, particularly US government, and investment-grade corporate bonds, were punished this week with the Barclays US Aggregate Index down 0.3% for the week – driven primarily by the Fed’s wait-and-see approach to further easing. Rates across the yield curve rose with the most pronounced move in the 10-year Treasury, which increased from 1.73% a month ago to 1.92%.

On the other hand, high yield and emerging market bonds continued to perform well as spreads in these less popular fixed income categories tighten to historic lows. The Barclays High Yield Index is the best performing index YTD at 14.1% and despite my bullishness now long ago, I am becoming a bit more cautious. EM bonds, on the other hand, are seeing increasing inflows from investors as the search for yield expands to all corners of the world. As mentioned elsewhere in this article, there could be opportunities in EM – both equities and fixed income.

Source: ycharts

Themes to Watch

Banks

An analyst at Vining Sparks downgraded the Bank sector, lowering his rating on JP Morgan Chase (JPM), Bank of America (BAC), Wells Fargo (WFC), Citigroup (C), and several of the smaller national banks as well as a few regional banks.

Emerging Markets

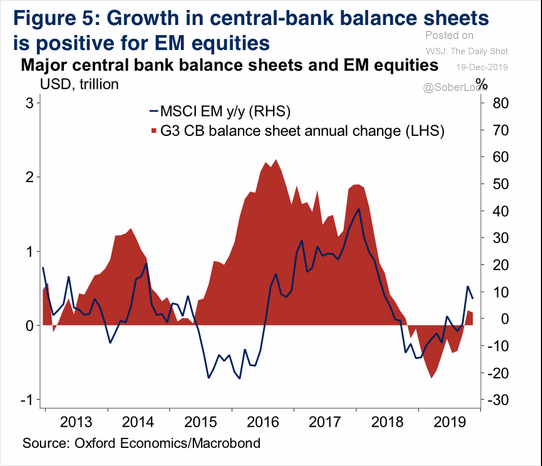

Earlier this year I suggested investors start paring back some of their US equities and start increasing exposure to international and emerging market equities. At a minimum, with US equities outperforming global markets, investors should at least rebalance their portfolios to their target weights – weights that surely have been distorted by US outperformance. Earlier this week, JP Morgan turned bullish on emerging market equities and bonds. They also cut their estimate of a recession from 40% to 25% now that trade tensions have diminished, and global monetary policies become more accommodative. The growth in central bank balance sheets has historically been a boost for EM equities.

A survey by the Wall Street Journal confirmed that the consensus of economists believe the probability of a recession have diminished.

Along the lines of a more favorable outlook for EM bonds, EM junk bond issuance is at a record pace, led by issuance in Asia and Latin America. This is not surprising considering the low rates on US Treasuries and highly rated corporate bonds. Personally, I prefer to venture into EM bonds by staying within the investment grade category but spreads on those have tightened considerably as well, leaving investors looking further down the credit spectrum for yield. I would suggest using an actively managed fund for exposure to this asset class and not trying to pick individual issues.

High Yield Dichotomy

The spread between CCC and BB rated junk bonds is as wide as it’s ever been. Part of the reason for this is similar to what is driving such high demand for EM bonds. That is, with investment grade bonds offering lower yields to investors, many have looked towards lower rated issues to boost the coupon payments that receive from their fixed income. BB+ is the highest rated non-investment grade bond category – in other words – it’s the best of the worst, and it offers yields that are considerably higher than investment grade bonds. However, the lower rated high yield bonds have continued to sell off despite a still low rate of defaults and an economy that continues to grow, even if just modestly.

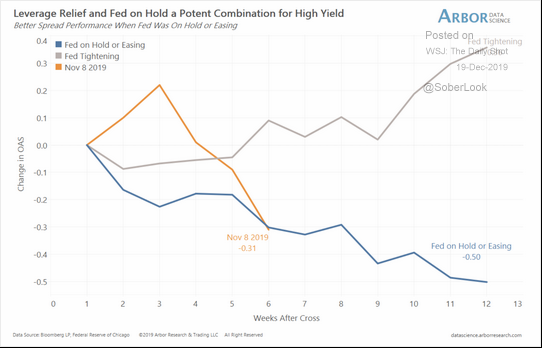

I wrote an article some time ago that there could be opportunities in the CCC category because of the historically wide spread between CCC and BB. Some data continues to indicate a favorable environment for high yield in general, but other data suggests otherwise. For example, when the Fed is on hold – as it is now – high yield spreads tend to narrow – that means that the price of high yield bonds tend to increase.

On the other hand, the spread between BB and BBB is the lowest it’s ever been so investors looking to get more yield today may not be getting much more by delving into the high yield space AND they might be taking a disproportionate amount of risk.

High-yield bonds have rallied mightily despite the lack of any observable broad-based acceleration of either business sales or corporate earnings,” Moody’s economist John Lonski said in a report. “If the anticipated improvement in the fundamentals governing corporate credit quality do not materialize, a significant widening of high-yield bond spreads is likely.”

Heard on the REITs

Wheeler REIT Nominates New Board members Promising Change

The Stillwell Group, which is Wheeler REITs (WHLR) largest shareholder, won three seats on the board led by Joseph Stilwell. As investors and followers of Wheeler know, the company has been faced with a number of challenges that shareholders don’t think management handled in their best interest. According to Mr. Stilwell,

“We’ll work to clean up management, straighten out the organization, and rationalize the corporate capital structure.”

Global Medical (GMRE) Forms Committee to Evaluate Management Internalization

GMRE formed a special committee to evaluate the possibility of internalizing management. REITs with external management – typically related parties – are often thought to be less focused on creating shareholder value and that the external manager oftentimes has conflicts of interest. For example, external managers usually get paid a percentage of assets they manage, making critics of external managers argue that the external manager has the incentive to grow at all costs – even if it involves issuing additional equity (diluting current shareholders) or increasing debt (reducing cash flow available to shareholders and threatening the financial stability of the company). The internalization may have it’s own costs, however. If the committee determines it is the best course of action, the value paid by the company to the external manager will be 3x the average annual base management fee and average annual incentive fee paid by the company to the adviser during the previous two years. Stay tuned for more on this.

Several REITs announce Dividend Boosts This Week

- W.P. Carey increases it’s dividend by 0.2% to $1.038 per share

- Urstadt Biddle Properties declares $0.28 dividend, an increase of 1.8%

- Boston Properties (BXP) increases its dividend by 3.2% to $0.98 per share

- Invesco Mortgage Capital (IVR) boosts it’s dividend by 11% to $0.50 per share.

Consumer Corner

A Broker License Shouldn’t Allow Someone to Invest in Private Markets

The SEC proposed new rules to it’s limitations that preclude retail investors from investing in private markets such as private equity, hedge funds, and venture capital. The current rule requires an investor to be considered accredited, which is defined by income and net worth, not by knowledge or education. To meet the standard, individual investors must have at least $200,000 in annual income or $1 million in net assets, not including their home.

The new proposal would allow investors with certain qualifications, such as an entry level broker’s license, to qualify without meeting the income and wealth thresholds. While I agree with exempting investors with certain qualifications, the broker license provides absolutely zero education and knowledge about how to perform due diligence on a private investment. It’s focus is on making sure brokers understand the regulatory requirements and what they can and cannot do to SELL products to their clients and prospective clients. No offense to someone that has a Series 7, but an exam that could be passed within days even without any investment knowledge should not be a qualification that allows for investing in private markets. The SEC should seriously consider the repercussions of this change.

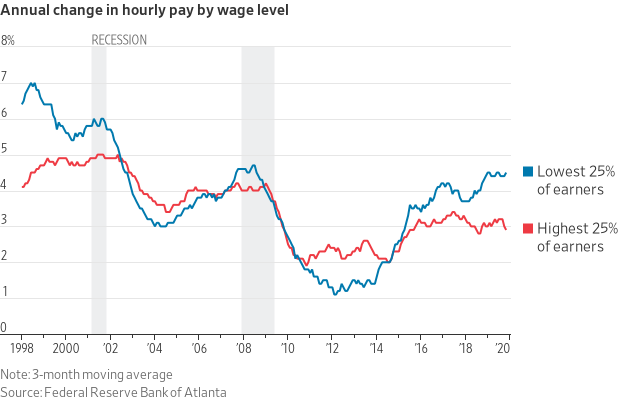

Wages are Increasing – Ask for a Raise

If you haven’t gotten a raise soon, it might be time to have a nice long chat with your immediate supervisor. The annual change in hourly pay for lower wage earners has been increasing at around 4.5% and trending higher. That is not the case for higher wage earners but even high earners have seen their pay increase by 3%.

Comments are closed.